Business Plan Services

July 27, 2022

Cities Skylines Citrix Workspace

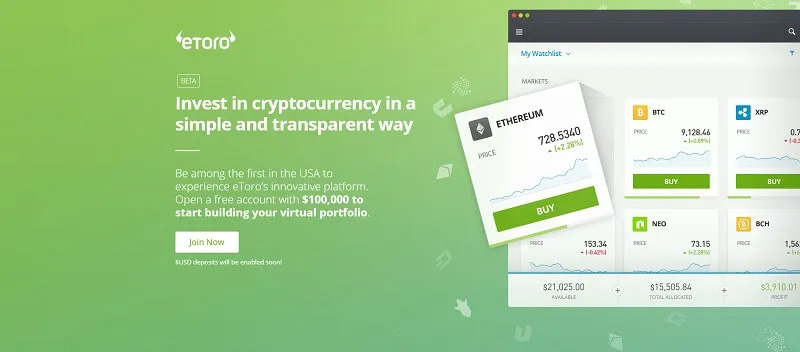

July 27, 2022eToro USA Review – What You Need to Know

In this eToro USA review, we’ll take a look at the multi-asset brokerage’s services, including its social trading options and webtrader. While you should know that eToro charges no management fees, you’ll still want to consider how the company’s social trading features stack up. While we can’t guarantee that all eToro features are safe and sound, we can say that the eToro site’s basic research tools, education resources, CopyTrader, and social features make this a solid choice for those who want to trade. Forex traders lifestyle can be improved after getting right information about best brokers.

eToro is a multi-asset broker

While eToro is an online multi-asset broker, it’s important to note that it’s not suitable for everyone. There’s no magic formula to make money on the platform, and you’ll need to understand how to trade correctly before you try it out for real. To get started, sign up for a free demo account and try out trading before you invest any real money. In addition, you should try out different instruments, such as cryptocurrencies, before you decide to invest real money.

eToro offers a variety of trading instruments, including stocks, cryptocurrency, and CFDs. The platform itself is proprietary and is widely recognized as one of the most innovative in Europe. Those who use it should expect low commissions, competitive spreads, and no commission trades. But that doesn’t mean you shouldn’t invest at all. Besides, you can also try copy trading, which is a good way to copy successful traders and reap the rewards.

It offers social trading

eToro USA offers social trading on its website. By following the trades of other eToro users, you can copy their strategies. However, you should keep in mind that copying other people’s strategies involves a high risk, as they may be unprofessional or inexperienced. In addition, your own trading decisions may differ from theirs. The content on eToro’s website is generated by the community and does not represent eToro’s recommendation or advice.

eToro is an online brokerage founded in 2007 in Tel Aviv, Israel. The company has more than ten million users and changed its corporate strategy to become a leader in the retail trading space. Initially, eToro operated as a forex online broker. Later, it expanded its services to include stocks, commodities, and indices. In 2010, eToro launched its social trading feature, which allowed users to copy the trades of successful traders. The popularity of the platform made eToro the world’s largest social trading network.

It does not assess a management fee

If you’re considering trading U.S. stocks or ETFs, eToro has you covered. This broker does not charge a management fee. It also doesn’t charge commissions, ticket fees, or rollover fees. It is also fully audited to ensure fairness in the market. While eToro does assess some other fees, there are no additional charges for trading U.S. stocks.

The eToro spread is the difference between buy and sell prices. It is equivalent to the Bureau de Change markup on stocks. eToro charges its fees on leveraged stock and cryptocurrency pairs. The company also does not assess a management fee for investing in individual cryptocurrencies. eToro has earned a reputation for being a trustworthy platform for investors. The website uses the highest encryption standards and security system to safeguard your account from cyberattacks.

It offers a webtrader

The eToro USA webtrader is one of the social trading platforms that allows US traders to invest in crypto currencies. The site is regulated by FinCEN and operates as a cryptocurrency broker in the United States. While the webtrader doesn’t provide the analytics and reporting that professional traders require, it does allow signal providers to earn through the popular investor program. Traders can also make money by creating and promoting their own signals and other content.

Users of eToro can monitor a trader’s overall performance, copy their trades, and close individual trades. While there is no way to copy a trader’s entire portfolio, you can monitor each trade and close it at any time if you find the trader’s performance disappointing. You can also view your own investments and copy them if you want.