Youtube Download To Mp4

July 20, 2022

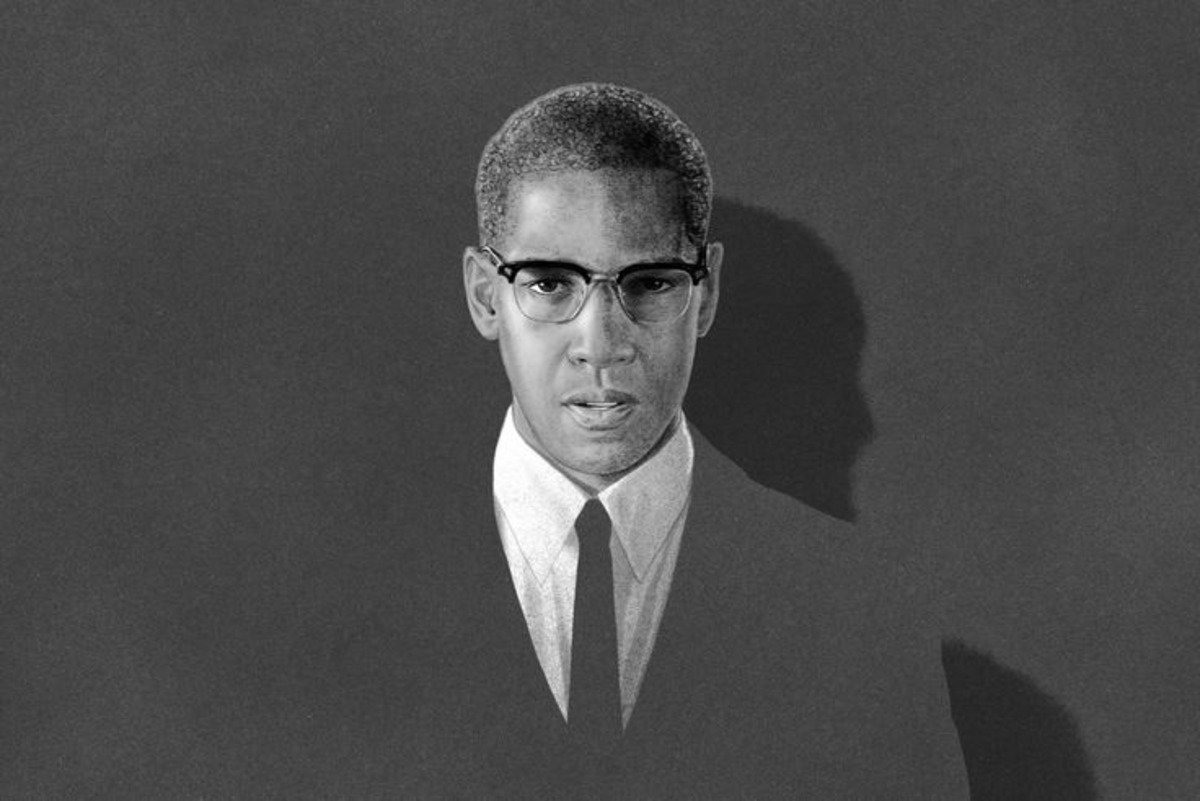

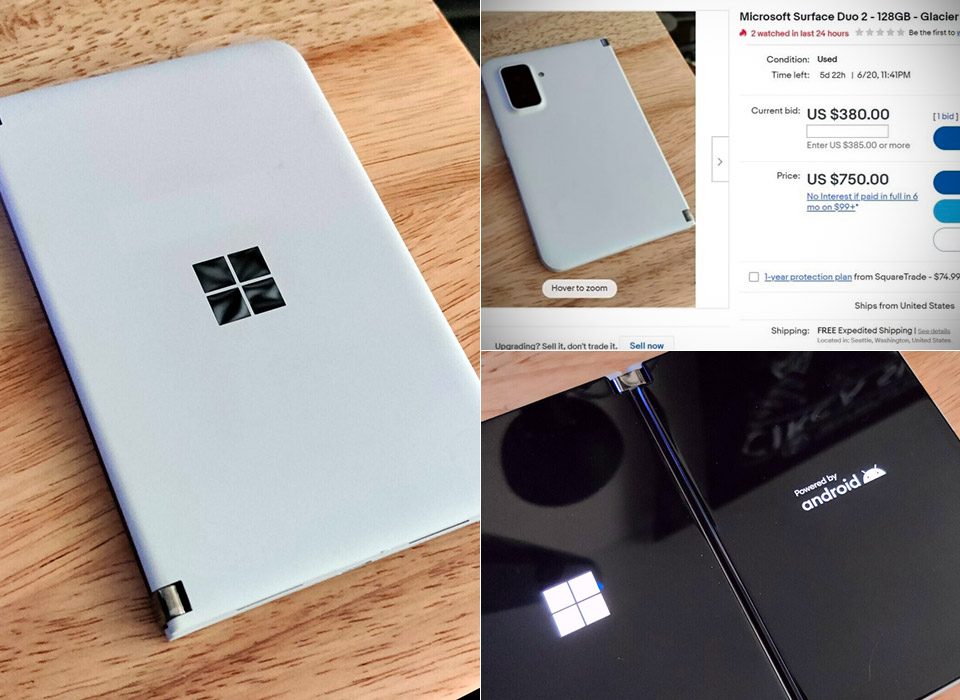

Canceled Cheaper Surface Duo 2 Appears Online

July 21, 2022The reason behind the high gas prices is simple: higher oil prices cause the price of gas to rise. Since oil is a key input in the production of gasoline, the higher the price, the higher the cost of gas. In the past, pandemic demand for gasoline lowered gas prices, but the recent invasion of Ukraine by Russia has only exasperated the problem. Invading countries like Russia no longer buy oil from them. This reduces the supply of oil. Gasoline prices must go down as long as oil supply and demand balance.

Refining costs account for 17% of the price per gallon of gas

Refining costs make up nearly a quarter of the retail price of gas, according to the FTC. These costs include the cost of processing crude oil and the transportation of the refined products, such as trucks and pipelines. In addition, taxes on petroleum products and distribution are an additional 18 percent of the total cost. As of this writing, the national average price for regular unleaded gasoline is almost $5. In California, the price of gas is currently 47 cents per gallon.

While refining is the largest single expense in gasoline, ethanol is already replacing about 10 percent of the gasoline supply. It is also dislodging four refineries in the Marcus Hook region, where it is needed most. The government’s ethanol policy is likely to have a big impact on the cost of gasoline, as the demand for it will fall. But, there are some positives.

Demand for gasoline plummeted during the pandemic

The pandemic in March 2020 caused demand for gasoline to drop dramatically. The typical American cut back on driving by half. The decline in demand caused gas prices to spike. Then, as the economy recovered, demand increased. The price of gas climbed back up, and the average per gallon price rose by nearly half. This is the first time in over four years that gas prices have gone up by more than 40%.

The pandemic caused a global drop in demand. This was due in part to governments limiting movements. Then, the collapse of the pandemic started to affect the economy as a whole. In March, the U.S. economy returned to a more normal pace. This has made gas prices rise once again. However, the pandemic has also increased global demand for coal, natural gas, and oil.

Russia’s invasion of Ukraine

The recent Russian invasion of Ukraine has prompted fears that gasoline prices will spike. Even though the United States is not extending its sanctions to Russia’s energy supplies, the price of crude oil is projected to rise, affecting U.S. consumers and businesses. Prices are already among the highest they’ve been since 1982. Earlier this week, President Biden acknowledged that US sanctions against Russia’s biggest banks could drive prices higher. And even though the Strategic Petroleum Reserve is at its lowest level in 20 years, it still holds as much oil as Russia produces in 50 days.

The economic impact of the conflict has reverberated throughout the world, and many households are wondering how this war with Russia will affect their wallet. Gasoline has already risen, and food and smartphone costs may rise. There will be shortages of raw materials, and a disruption in the supply of these commodities will lead to inflation. And that disruption would impact everyone. That is why President Biden has warned that the U.S. government should make every effort to counter Russia’s aggression.

Supply-demand imbalance

The reasons behind gas prices going up are simple – an imbalance between demand and supply. This imbalance results in higher prices of both crude oil and gasoline. It exacerbated by the Russian invasion of Ukraine and its subsequent sanctions on Russian oil. In addition, a global slowdown in oil production prompted producers to cut production. This, in turn, contributed to the increase in prices. However, many Republicans blame Democrats for causing this imbalance.

The rise in gas prices is due to the lack of supply in some regions. This has led to a spike in overall energy prices, which has impacted other commodities like food and rents. Many economists are watching the rise in fuel prices to assess their impact on consumer sentiment. The increase in wages and job market work as a insulator against higher prices. However, higher prices do not make consumers spend less.

Value of the dollar

When it comes to the dollar, the weaker the dollar is, the higher the price of oil is for Americans. However, the weaker dollar makes the same oil cheaper for other countries, which increases the world demand for oil. This in turn drives up the price of oil. However, most of these factors only temporarily affect the price of oil, and the dollar’s value can shift over time. Therefore, the weak dollar isn’t a permanent cause for increased prices.